"Smells Like A 'Truss Moment'" - UK Gilt Yields Hit 16 Year High, Stocks & Cable Tumble

"Smells Like A 'Truss Moment'" - UK Gilt Yields Hit 16 Year High, Stocks & Cable Tumble

UK Gilt yields topped 4.80% for the first time since 2008 this morning (up 12bps on the day) having blasted higher since The Fed started on its rate-cutting cycle...

This is not (yet) a Truss-style repudiation of the UK bond market... but it's getting there.

“While the speed and extent of the move higher in bond yields has not been anywhere near as violent as that witnessed following the Truss budget in 2022, the impact of higher rates on the economy, particularly via higher mortgage rates, is not to be underestimated,” said Matthew Ryan, head of market strategy at Ebury.

A number of factors are weighing on gilts: supply concerns, sticky inflation and uncertainty whether the new Labour government are enacting the right policies to bring the country back on track.

While the latest increases don’t yet mirror the scope of those seen two years ago when Liz Truss’s disastrous mini-budget prompted a buyers’ strike, the spreading discomfort has investors nervous and risks complicating the calculus for the government as it looks to finance its spending plans.

The inflation outlook prompted traders to pull back their expectations for the Bank of England to cut interest rates this year, and came as yields globally soar as markets weigh the impact of potential tariffs from US President-elect Donald Trump on prices.

“This isn’t a healthy move,” said Megum Muhic, a strategist at RBC.

“General concerns surrounding debt sustainability, resurgence of inflation and potentially inflationary Trump policies are all contributing to the narrative.”

But such a rout is always a possibility when you are heavily reliant on the kindness of strangers - as Bloomberg's Simon White notes, almost a third of UK sovereign debt is owned by foreigners.

And unlike UK entities such as pension funds, they have no obligation to own any of it.

UK yields have been outpacing US ones as foreigners own an increasing share of the gilt market – in effect, overseas investors want a greater discount to hold more UK debt.

As Bloomberg reports, Thursday’s price action is particularly concerning for traders because a slump in the pound accompanied the rise in UK rates.

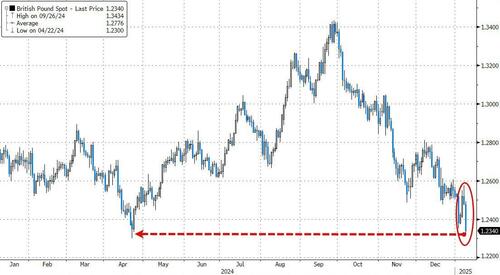

Cable was also clubbed like a baby seal, back to its weakest since the April 2024 lows...

Meanwhile, UK domestic shares tumbled, with the FTSE 250 mid-cap stock index heading for its worst two-day slump since August.

“The rise in yields is a painful blow, and it looks like, rather than being given new funds to help drive growth, government departments will have to make further cuts,” said Chris Beauchamp, chief market analyst at IG Group.

“UK stocks remain cheap, and for all the wrong reasons.”

The slide in bonds Wednesday was exacerbated by positioning as long positions in gilt futures were stopped out, according to traders. The gilt market has proved more volatile than other major bond markets in recent years, with investors often citing periods of poor liquidity.

“It looks like a small ‘Truss moment’ that could be amplified if investors start to price a more dovish BOE,” said Roberto Cobo Garcia, head of G10 FX strategy at BBVA.

However, much has changed since the 2022 crisis. The liability-driven investment strategies at the heart of the crisis must now hold larger cash buffers in order to reduce the chance of another liquidity crisis after an international regulatory effort. The BOE is also developing a repo facility which will allow these funds to raise cash in the event of future turbulence.

Related Posts

Trump Inherits A Deeply Damaged Economy

Created" content="2025-01-09T12:45:00+00:00" class="field field--name-created field--type-created field--label-hidden">Thu, 01/09/2025 - 07:45 ...

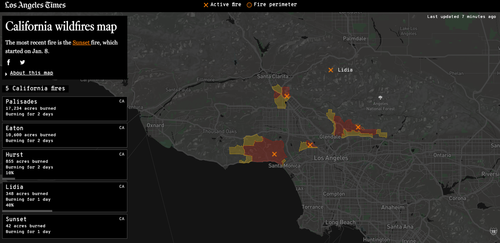

Inferno Chaos: LA Fire Spreads To Hollywood Hills, 2,000 Buildings Destroyed, Over 130,000 Evacuated

Created" content="2025-01-09T12:20:00+00:00" class="field field--name-created field--type-created field--label-hidden">Thu, 01/09/2025 - 07:20 ...

US Intelligence Believes Only 20 Israeli Hostages Still Alive In Gaza

Created" content="2025-01-09T11:55:00+00:00" class="field field--name-created field--type-created field--label-hidden">Thu, 01/09/2025 - 06:55 ...

Europe Races To Refill As Gas Reserves Dwindle

Created" content="2025-01-09T11:20:00+00:00" class="field field--name-created field--type-created field--label-hidden">Thu, 01/09/2025 - 06:20 ...

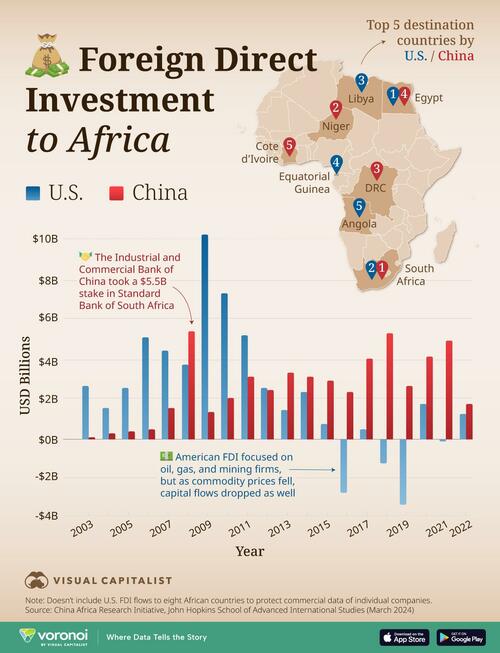

Visualizing 20 Years Of US & Chinese 'Investment' In Africa

Created" content="2025-01-09T10:45:00+00:00" class="field field--name-created field--type-created field--label-hidden">Thu, 01/09/2025 - 05:45 ...

Germany Faces Highest Number Of Bankruptcies Since Great Financial Crisis

Created" content="2025-01-09T10:10:00+00:00" class="field field--name-created field--type-created field--label-hidden">Thu, 01/09/2025 - 05:10 ...