Consumer Stocks Drove Strength In China Ahead Of Policy Presser To Boost Consumption

Consumer Stocks Drove Strength In China Ahead Of Policy Presser To Boost Consumption

Consumer shares led the overnight gains in China after officials announced plans to hold a press conference on Monday to discuss measures to boost consumption in the world's second-largest economy.

"The press conference on boosting consumption fanned expectations on policy support," said Shen Meng, a director at Beijing-based investment bank Chanson & Co., adding, "But if it falls short of providing details on increasing income, such optimism may weaken to some extent."

Goldman's Lindsay Matcham commented on the overnight gains:

"... risk on in Asia overnight with our China Humanoid Robot's basket (+5.5%) and CSI 300 reaching the highest level this year in anticipation of Chinese officials holding a press conference on measures to boost consumption ..."

On a separate note, Goldman's Shubham Ghosh and Sean Navin provided more color on the gains:

"Consumption names helped to drive the strength today as China Liquor and Consumption baskets closed the day +5.79 and 4.10% respectively. It is worth noting that next week there will be a consumption presser on Monday (NDRC, MoF, MoCommerce, PBOC, SAFE and MoHRSS to host presser at 3 pm on Monday)."

Renewed optimism for policy support from Beijing sent the CSI 300 Index up 2.43%, the highest level this year.

KGI Securities analyst Ken Chen said authorities will likely unveil new policies to subsidize consumer trade-in programs and efforts to strengthen the social safety net, including better childcare and elderly-care services.

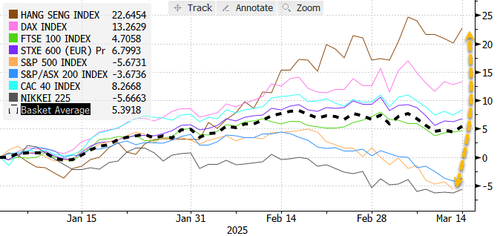

Hong Kong's Han Seng Index continued to power into a bull market this week, while the S&P500 Index closed down 5% on the year.

Last week, China maintained its GDP growth target at "around 5%" for 2025. Beijing may need to unleash the monetary cannon this year to achieve this goal. At the same time, the country faces internal challenges of a persistent property market downturn and external challenges, such as a worsening trade war with the US.

Related Posts

LISTEN: AI-driven extremism, U.S.-Russia talks, and the DOGE 'wrecking ball'

Trump's possible wedge strategy to divide Russia and China, and the "wrecking ball" that Elon Musk and the DOGE have taken to the federal government. ...

Top Trump Impersonator Shawn Farash, Wife 'Swatted,' Guns Pointed at House—Vows 'I'm Not Going to Stop'

ng, “We’re going to fight Trump in the streets,” a sentiment echoed by extremists like Rep. Maxine Waters (D-CA) and Connecticut Sen. Chris Murphy.]]>...

President Trump's Tariffs: A New Golden Age For American Aluminum Workers

Created" content="2025-03-14T11:45:00+00:00" class="field field--name-created field--type-created field--label-hidden">Fri, 03/14/2025 - 07:45 ...

Consumer Stocks Drove Strength In China Ahead Of Policy Presser To Boost Consumption

Created" content="2025-03-14T11:20:00+00:00" class="field field--name-created field--type-created field--label-hidden">Fri, 03/14/2025 - 07:20 ...